Handle everything that relates to your membership,

your benefits and your payment online. Forms in English here

Apply for benefits and fill in your timesheet

View your payments and change your contact details.

To sign in to our online services you need a valid e-identification (BankID) on your computer, smartphone or tablet. You use it to authenticate yourself and make electronic signatures. You obtain e-identification via your internet bank or at Telia.

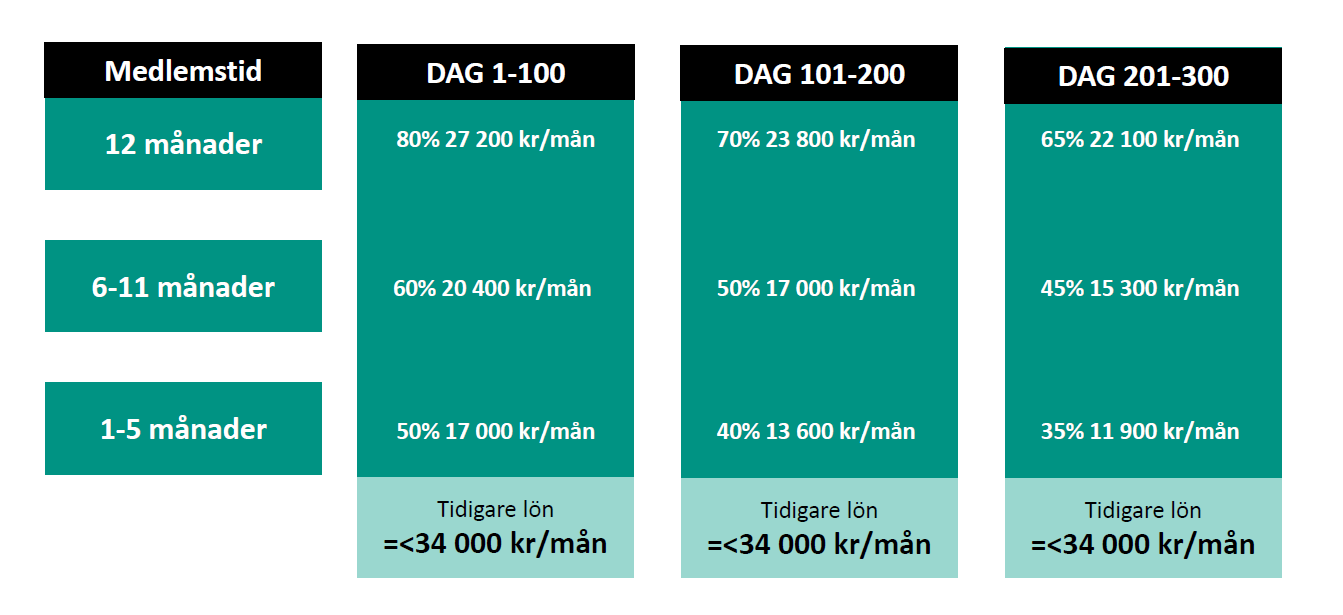

Unemployment insurance covers part of the income lost when you become unemployed. The maximum amount you can receive is 80 percent of 34,000 kronor. The compensation level depends on how many months you have been a member. The length of the compensation period depends on how many months you have had an income of at least 11,000 SEK. Initially, you can receive a maximum of 80 percent of 34,000 SEK and 300 compensation days. A fixed monthly income of 34,000 SEK corresponds to an annual income of at least 408,000 SEK.

These rules take effect on 1 October 2025.

The qualifying period is the 12-month period during which you must meet the income requirement. The income during this period determines the compensation you can receive. It begins the month before registering with Arbetförmedlingen (the Swedish Public Employment Agency) and extends 12 months backwards. If there are months where you could not work due to illness, childcare, or studies, the qualification period is extended by the same number of months. Read more here about what can extend the qualification period.

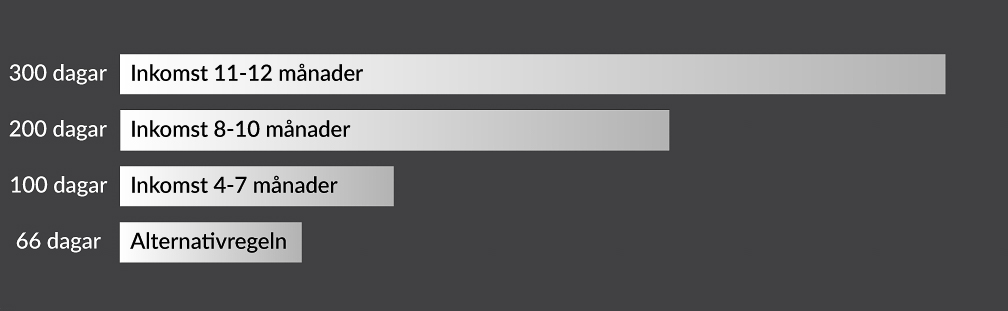

The length of the compensation period depends on how many months during the qualifying period you have earned at least 11,000 SEK – the more months with income, the longer the period. The maximum compensation period is 300 days. Those who meet the alternative rule (having earned at least 11,000 SEK per month for four consecutive months) can receive unemployment benefits for a maximum of 66 days.

For those who are fully unemployed, benefits are paid for about 22 days per month.

To receive compensation, you must be a member of an unemployment insurance fund (a-kassa). If you have not joined before becoming unemployed, it is possible to become a member then. However, it is recommended to join immediately upon starting work, as the length of the membership determines the compensation level:

80 percent – At least 12 months of continuous membership and membership throughout the qualifying period.

60 percent – At least six months of continuous membership, covering at least four months with an income of 11,000 SEK per month.

50 percent – Membership for 0-5 months.

The compensation level decreases every 100 days. After 100 days, the compensation level is reduced by 10 percentage points. Every 100 days thereafter, the level decreases by an additional five percentage points.

The highest possible compensation from the unemployment insurance fund is 300 days at 80 percent of 34,000 SEK. Since 34,000 SEK corresponds to an annual income of 408,000 SEK, the highest compensation is 27,200 SEK before tax for the first 100 days. After 100 days, the compensation level decreases by 10 percentage points, followed by a five percentage point reduction every hundred days thereafter.

Unemployment benefits are calculated and paid out monthly in arrears.

Monthly applications must not be older than three months.

He has been a member of the unemployment insurance fund for four years, worked full-time for two years, and had an average salary of 40,000 SEK per month before becoming unemployed.

He qualifies for a 300-day compensation period. For the first 100 days, he is entitled to 80 percent of 34,000 SEK.

Later, Per gets a part-time job earning 20,000 SEK per month.